Variation on HP Agreement upon request. Instead the contract notes may attract stamp duty at 01 percent.

The Validity Of Unstamped Agreements In Malaysia Fareez Shah And Partners

The holding period is from the date on the Sales and Purchase Agreement SP until the disposal date.

. Stamp duty is payable under Section 3 of the Indian Stamp Act 1899. It is a common. According to Amit Modi Director ABA Corp A Joint Development Agreement JDA is beneficial for both the owner as well as the developer.

And here are 4 of the more important points to pay attention to. RM 310 for account without guarantor. The only challenge that can be made is an application to the High Court to set aside the award.

The stamp duty for the sale and transfer of a property is calculated based on the purchase price. The transfer of securities on the Central Depository System does not attract ad valorem stamp duties at 03 percent. Stamp duty on rental agreements.

Stamp duty is 1 of the total rent plus deposit paid annually or Rs. Competent consideration for the landlord. RM 1000 per agreement for stamp duty.

Buy Rent Condos New Launches Find Agent Guides. Partial avoidance of stamp duty. There is no appeal against an award made in Malaysia under the Arbitration Act 2005.

Agreements that are not made on Stamp Paper. RM 2000 per agreement for documentation and stamp duty. This SPV was formed by a joint venture agreement executed between Mazda Motor Corporation and Bermaz Motor Sdn Bhd on 11 September 2012.

Calculation of Stamp Duty on SPA Memorandum of Transfer and Instrument on Loan Agreement. A sale and purchase agreement in Malaysia is one of the most important documents youll encounter when you buy a house. So if you need to be on a safer side you can make the agreement on a Stamp paper of.

Stamp duty is the governments charge levied on different property transactions. The agreement should be printed on a Stamp paper of minimum value of Rs100 or 200-. You need to pay a stamp duty when you buy a property and also when you go in for a rental agreement.

Section 35 of the Stamp Act makes a document which does not bear a requisite stamp duty as inadmissible in a court of law. However according to Stamp Duty Remission Order 2003 all contract notes relating to the sale of any shares stock or marketable securities listed on a stock exchange approved under subsection 82 of the. Also read all about income tax provisions for TDS on rent.

Such an application has to be within 90 days of the receipt of the award. RM 930 for account with 2 guarantors. One example of an incorporated joint venture in Malaysia is the formation of Mazda Malaysia Sdn Bhd.

The only discrepancy of an unstamped agreement is producing an unstamped agreement in court as evidence. 500- whichever is lower. The principal objective of the joint venture was to increase the local assembly and manufacturing activities of Mazda in Malaysia.

Additionally a waiver on the taxable amount is granted to individuals but not companies. In addition if a loan was taken out to finance the purchase of the property the stamp duty payable would be a flat rate of 05 of the total loan amount. RM 620 for account with 1 guarantor.

You will be only be taxed on the positive net capital gains which are disposal price less the purchased price less the miscellaneous charges such as stamp duty legal fees advertisement charges etc. The grounds for setting aside such an award are limited to fraud or breach of the rules of natural justice or where the award is contrary to. RM1000 per agreement for stamp duty.

However this provision has certain exceptions and does not completely. Fast-paced development of the property as working capital is majorly required for meeting the construction needs.

Tenancy Agreement In Malaysia The Ultimate Guide Speedhome Guide

Tenancy Agreement Stamp Duty Table Tenancy Agreement Agreement Stamp Duty

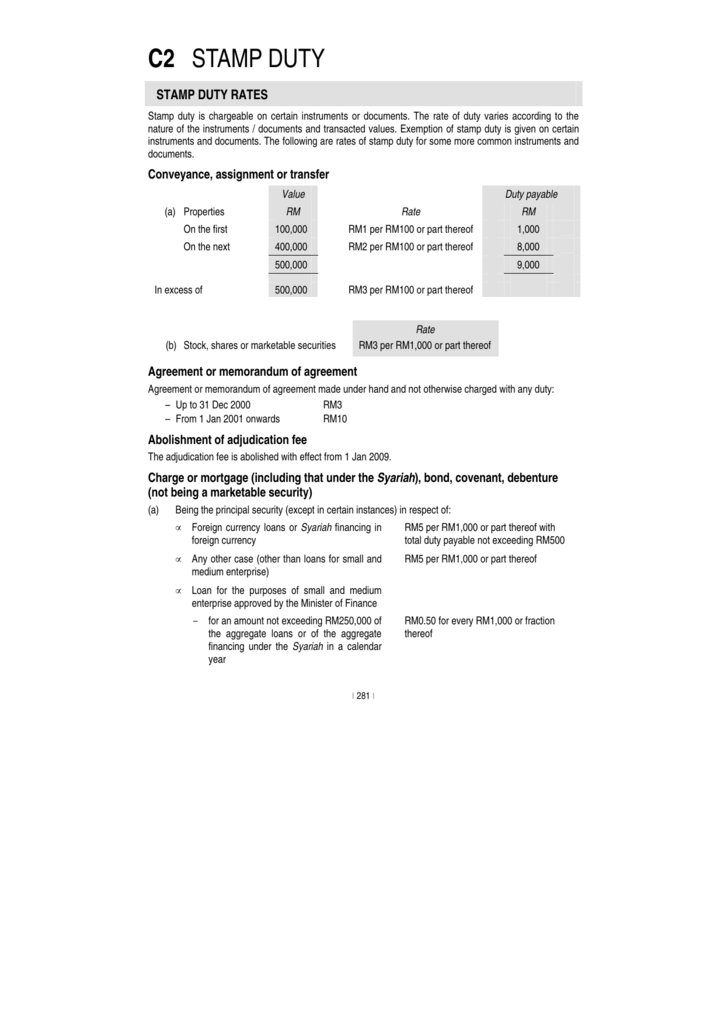

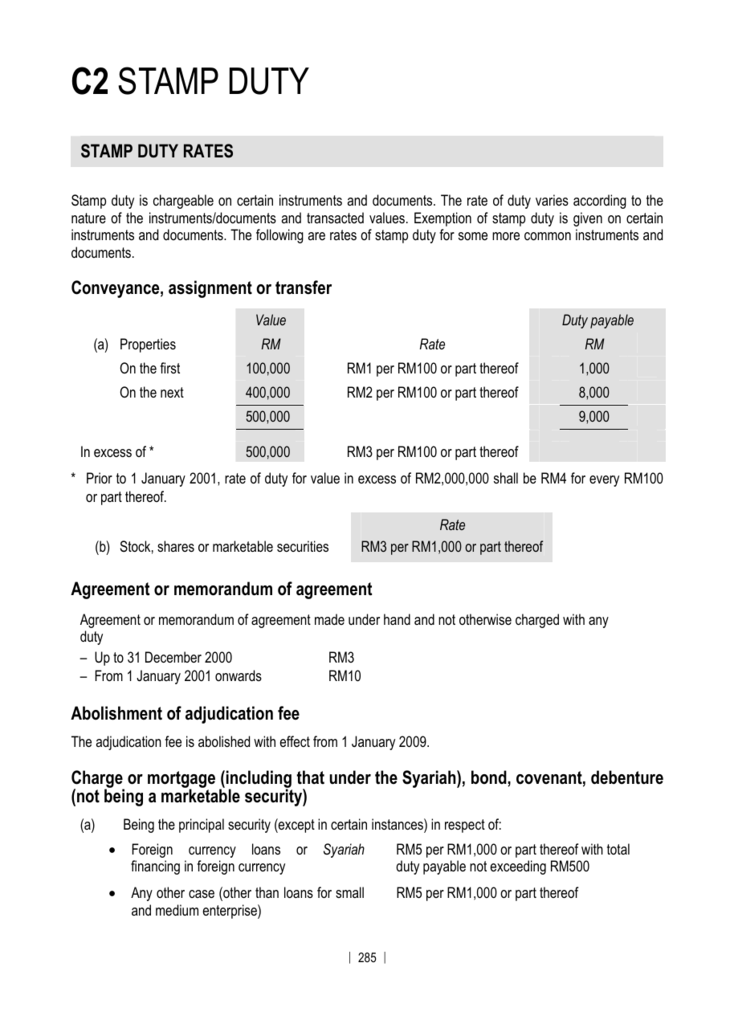

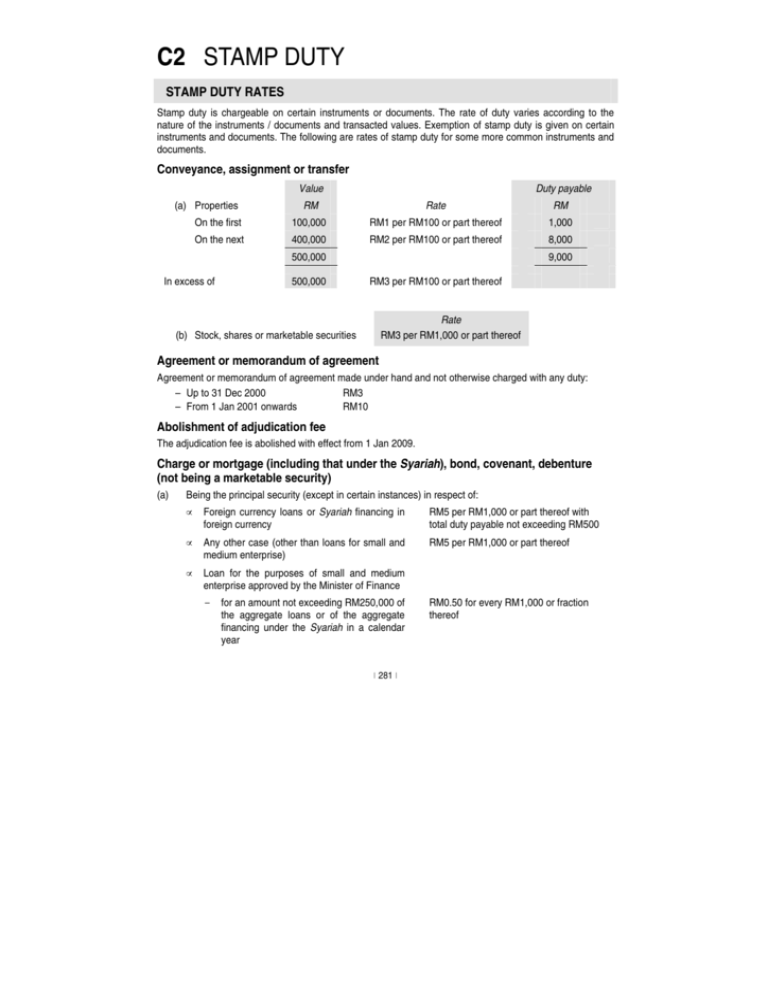

C2 Stamp Duty Malaysian Institute Of Accountants

Proposed Ad Valorem Stamp Duty To Be Paid When Contract Signed Publication By Hhq Law Firm In Kl Malaysia

Malaysia 2021 Vs 2022 Stamp Duty On Share Trading Contract Notes Youtube

Stamp Duty And Contracts Yee Partners

Why Could This Green Chop Cost You Thousands Of Ringgit Asklegal My

Malaysian Stamp Duty Handbook 6th Edition Marsden Professional Law Book

Stamp Duty Imposed For Transfer Of Properties In Malaysia By Tyh Co

Why Could This Green Chop Cost You Thousands Of Ringgit Asklegal My

If A Tenant Damages Your Property In Malaysia Asklegal My

What To Remember About Stamp Duty In Malaysia

C2 Stamp Duty The Malaysian Institute Of Certified Public

Contactless Rental Stamp Duty Tenancy Agreement Runner Service Photos Facebook

C2 Stamp Duty Malaysian Institute Of Accountants

Stamp Duty And Administration Fee 2 Important Aspects For Tenancy Agreement In Malaysia

Stamping A Contract Is An Unstamped Contract Valid

Ws Genesis E Stamping Services